The Estate Bond is a financial planning strategy designed to increase the size of anyone’s estate by moving surplus funds exposed to tax into a tax-deferred life insurance policy.

Why does it work?

- Provide life insurance protection that increases the size of a client’s estate today, and in the future.

- Opportunity to create cash value that grows on a tax-deferred basis, that may increase the insurance benefits payable at death

- Reduces the amount of tax-payable while living

- May help reduce estate settlement costs

- May offer protection from creditors

How does it work?

When purchases an exempt life insurance policy in your life and designates an individual or a charitable organization as the beneficiary of the life insurance policy. At the time of the client’s death, the life insurance proceeds are paid to the client’s beneficiary, tax-free.

Who is it for?

- Individual, Canadian-resident taxpayer

- In good health

- Age 45 years and older

- Strong desire to leave a legacy at death

- Affluent, with surplus funds available to invest

- Receptive to long-term planning strategies

An example

In this example, the client is a 60-year-old female, non-smoker. She wants to leave a legacy for her children when she dies. She plans to invest $30,000 for the next 10 years in a life insurance policy. Her personal tax rate is 45%.

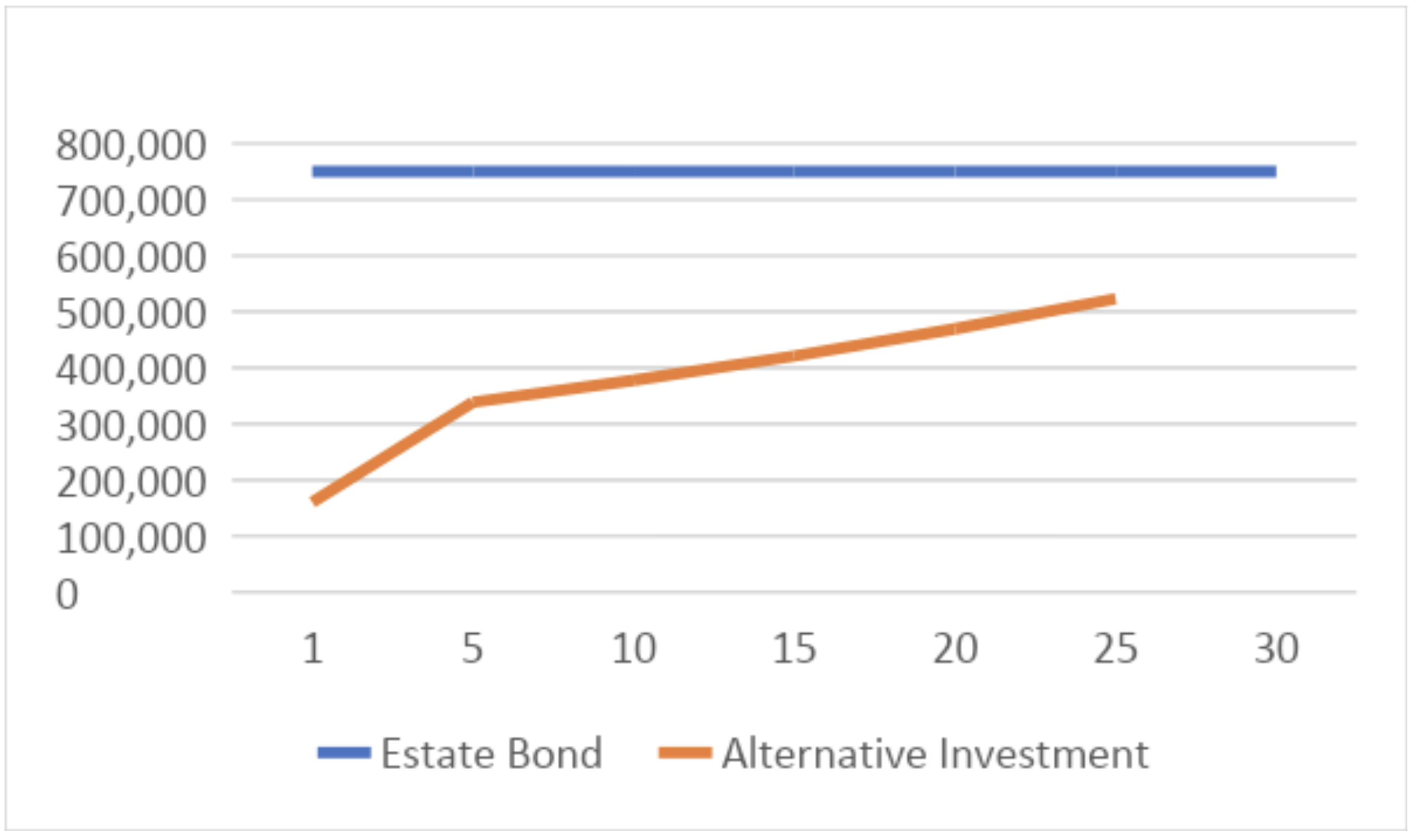

By starting with a $750,000 initial death benefit, and assuming a minimum guaranteed rate of return of 1.50%, here’s how the Estate Bond strategy can increase the size of the gift she’ll leave her children.

| Personal Information | Female, age 60, non-smoker |

|---|---|

| InnoVision rate of return | 1.50% |

| Initial death benefit | $750,000 |

| Deposits | $30,000 per year for 10 years |

| Personal tax rate | 45% |

| Before tax investment rate for alternative investments | 4% |

| After tax investment rate for alternative investment | 2.20% |

| Accumulated value ($) | Before tax redemption value ($) | Net estate value ($) | Year | Annual interest ($) | Tax payable ($) | Net Estate value ($) |

|---|---|---|---|---|---|---|

| 25,053 | 0 | 750,000 | 1 | 1,200 | 540 | 30,660 |

| 127,339 | 90,874 | 750,000 | 5 | 6,270 | 2,821 | 160,195 |

| 263,536 | 263,536 | 750,000 | 10 | 13,260 | 5,967 | 338,805 |

| 243,132 | 243,132 | 750,000 | 15 | 14,785 | 6,653 | 377,749 |

| 182,360 | 182,360 | 750,000 | 20 | 16,484 | 7,418 | 421,171 |

| 22,258 | 22,258 | 750,000 | 25 | 18,379 | 8,271 | 469,583 |

| 25,532 | 25,532 | 750,000 | 30 | 20,492 | 9,221 | 523,561 |

Estate Bond can increase the amount of cash that will go to client’s heirs by over $225,000 in year 30