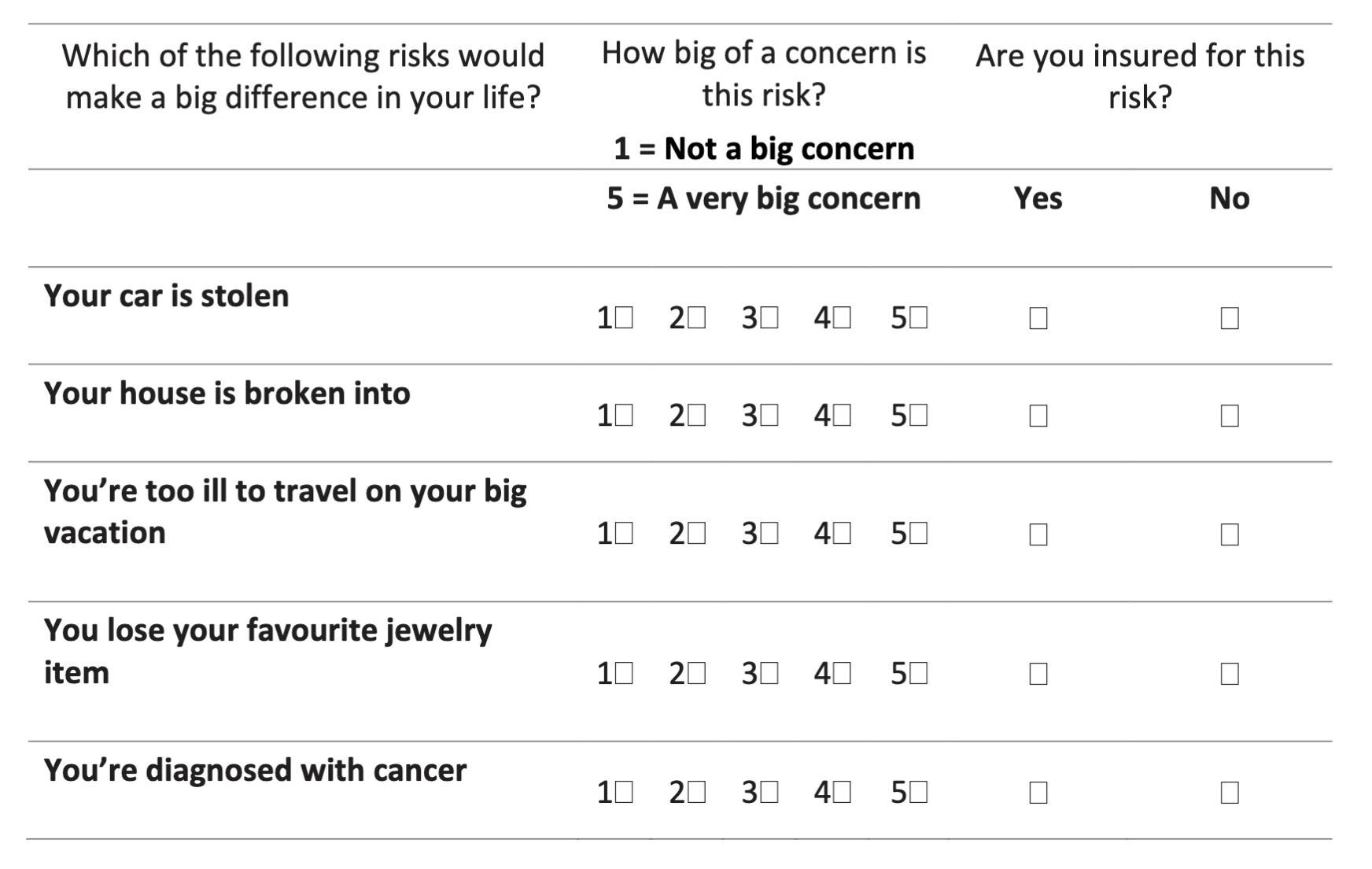

While you can’t always prevent bad things from happening, you can help to protect yourself against some common risks.

You buy car insurance in case you have a car accident. You purchase home insurance in case of a fire. But are you covered for other risks that may have a major impact on your life?

That’s why there’s Lifecheque

Facing a critical illness can be emotionally and physically devastating. It can also lead to significant and unexpected costs that may not be covered by your provincial or employee health plans. And the last thing you want to think about as you recover is how to cope with the financial burden. That’s where Lifecheque can help.

What is Lifecheque?

It’s critical illness insurance that provides a lump sum cash benefit if you’re diagnosed with one of the covered conditions outlined in the policy and satisfy the waiting period. The money is yours to use however you want. You can use it to:

- Help pay for your medical bills and prescriptions

- Replace lost income or make mortgage payments

- Hire a nurse or caregiver to help you out at home

If you’re like most Canadians, chances are you said “no” to the last risk. Most of us don’t expect to suffer a critical illness like a heart attack or a stroke or be diagnosed with a serious disease such as cancer. But these events can happen. Life is unpredictable. Make sure you’re protected with Lifecheque.